Share of informal economy drops from 52% to 15-20% post digitalisation, demonetisation, GST: SBI report

The COVID19 pandemic has led to a devastating impact on all the sectors of the economy but the impact has been felt more by the informal sector. While the formal sector is now back to its pre-pandemic level, the informal sector still continues to bear the brunt, says a new SBI report.

In India, around 93 per cent of total workforce is earning their livelihoods as informal workers. Photo: Pixabay

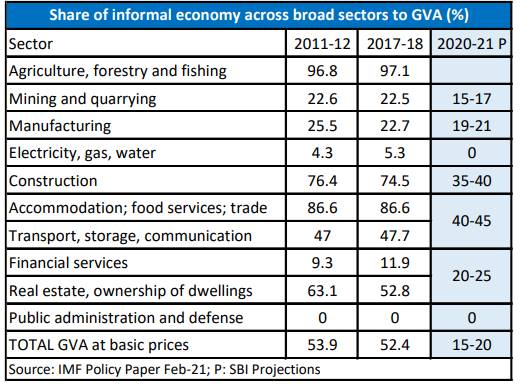

A report by the State Bank of India (SBI) shows the share of the informal economy in the country’s gross domestic product (GDP) has come down from 52 per cent to 15-20 per cent in the past three years following the adoption of GST (Goods and Services Tax), enhanced digitalisation, and demonetisation.

The State Bank of India Research’s latest report titled ‘Ecowrap’ also stated that the COVID19 pandemic has led to a devastating impact on all the sectors of the economy, but the impact has been felt more by the informal sector. “While the formal sector is now back to its pre-pandemic level, the informal sector still continues to bear the brunt,” stated the report released on October 29.

“Our starting point is an assumption that the shrinkage in the economy post pandemic is mostly informal and hence the loss in output across sectors gives us a measure of the informal sector … currently the informal economy is possibly at max 15%-20% of formal GDP,” stated the report.

According to the National Sample Survey Office (NSSO), 2014, India has a large informal economy with around 93 per cent of its total workforce earning their livelihoods as informal workers.

Also Read: ‘Almost 50% informal workers didn’t receive full wages in the second wave lockdowns’

e-SHRAM contributing towards formalisation of employment

Despite the drop in the informal sector economy, there has been a positive development in the Indian economy amid the COVID19 pandemic, stated the SBI report.

As per the report, there has been an increase in the formalisation of the economy and a lot has changed in the country’s economy landscape since the financial year 2018. “… formalisation of the economy has increased since the adoption of GST, enhanced digitalisation and demonetisation,” it said.

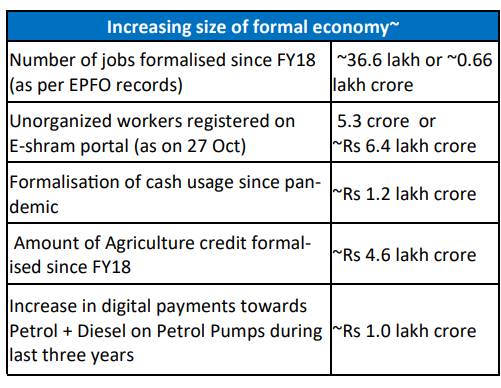

According to the SBI report, at least Rs 13 lakh crore (Rs 13 trillion) has come under the formal economy through various channels over the last few years, including the recent scheme on eSHRAM portal.

Launched this year on August 26, the eSHRAM portal, a database of unorganised sector workers, is the national database of unorganised workers including migrant workers, construction workers, gig and platform workers.

Calling it a game changer, the central government had said the portal would have the database of millions of unorganised workers and it would link them to social security and other schemes of the government.

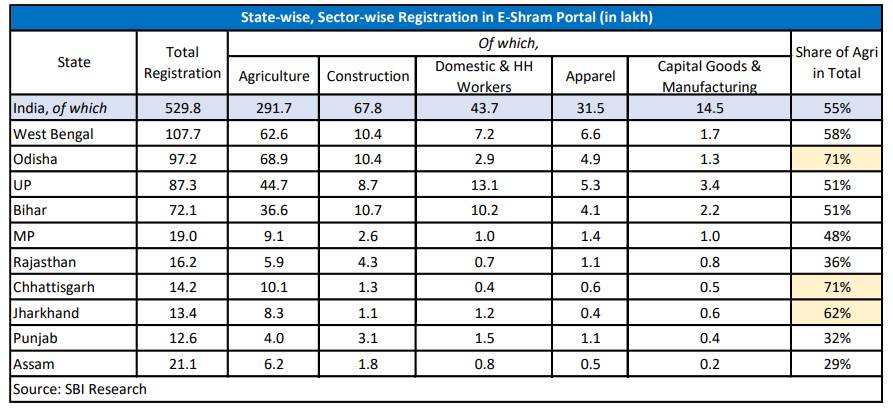

The SBI report highlighted that in two months, more than 5.3 crore (53 million) unorganised workers have registered with the online portal. Four states account for almost 73 per cent of the total registration, with West Bengal on the top, followed by Odisha and Uttar Pradesh.

According to the SBI report, workers from the agriculture sector account for 55 per cent of registration, followed by the construction sector (13 per cent).

“We believe that E-Shram is a big step towards the formalisation of employment. Our estimates indicate that till date the rate of formalisation due to E-Shram is around 15% and will increase further,” stated the SBI report.

Even in the agriculture sector, the usage of Kisan Credit Cards (KCC) has increased significantly and the report estimates Rs 4.6 lakh crore (Rs 4.6 trillion) formalisation only through the KCC route, with more marginalised farmers coming under the banking sector ambit through such usage.

The SBI report highlighted that the usage of KCC has increased significantly over the years. In the last 3-4 years the per card outstanding has increased from Rs 96,578 (in FY 2018) to Rs 167,416 (in FY 2022) — an increase of Rs 70,838.