Within a day of issuing an office memorandum slashing interest rates of small savings scheme, the government has withdrawn the order today on Thursday, April 1.

“Interest rates of small savings schemes of GoI shall continue to be at the rates which existed in the last quarter of 2020-2021, ie, rates that prevailed as of March 2021. Orders issued by oversight shall be withdrawn,” read a tweet from Finance Minister Nirmala Sitharaman.

Interest rates of small savings schemes of GoI shall continue to be at the rates which existed in the last quarter of 2020-2021, ie, rates that prevailed as of March 2021.

— Nirmala Sitharaman (@nsitharaman) April 1, 2021

Orders issued by oversight shall be withdrawn. @FinMinIndia @PIB_India

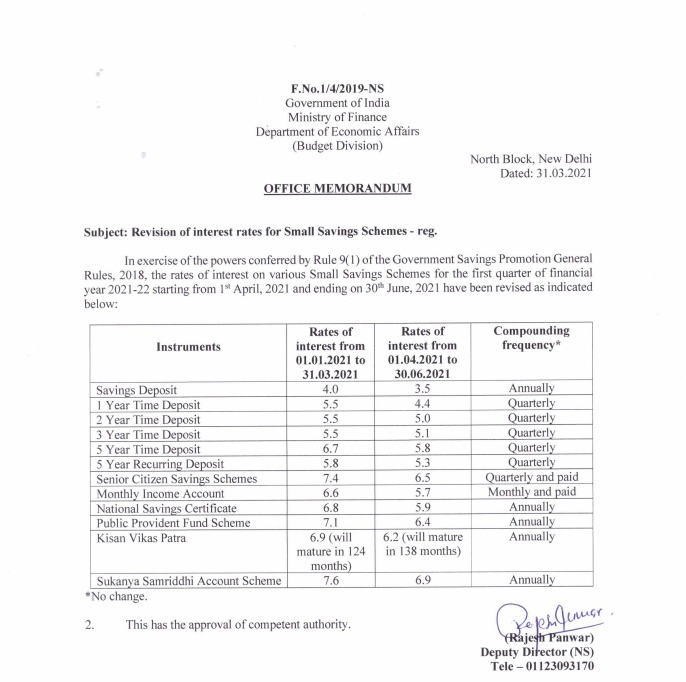

The central government notifies interest rates for small savings schemes on a quarterly basis. Yesterday, on March 31, the Department of Economic Affairs under the Ministry of Finance issued an order “revising the rates of interest on various Small Savings Schemes for the first quarter of financial year 2021-22 starting from April 1, 2021 and ending on 30th June 2021”.

As per the notification, the rate of interest was to be reduced on savings deposit by 0.5 per cent. It was reduced to 3.5 per cent as opposed to the earlier 4 per cent. Also, PPF interest rates were slashed from 7.1 per cent to 6.4 per cent, a 46 year low. This order has now been withdrawn.

Also Read: Government cuts interest rates of small savings schemes; PPF slashed to 6.4%