The Centre has made changes to the crop insurance scheme. Will this affect the farmers?

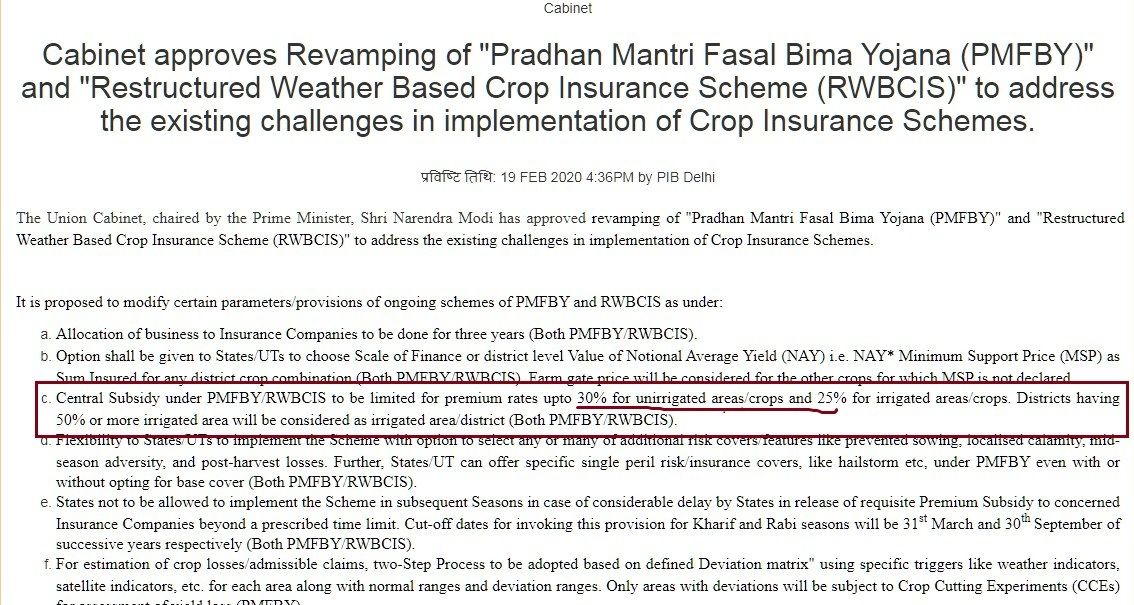

The Centre has almost halved its contribution to the Pradhan Mantri Fasal Bima Yojana, slashing its share of the premium subsidy from the current 50% to just 25% in irrigated areas and 30% for unirrigated areas from the kharif season of 2020. However, it has made enrolment in the scheme voluntary

The government at the Centre has made changes to the crop insurance scheme – Pradhan Mantri Fasal Bima Yojana — which was launched by Prime Minister Narendra Modi on February 18, 2016. The Centre has also made changes to the Restructured Weather Based Crop Insurance Scheme.

These changes, which would be implemented from the Kharif season of 2020, were made at a Cabinet meeting led by Prime Minister Narendra Modi on February 19. Now, enrolment in the two schemes has been made voluntary for all farmers, including those with existing crop loans. When the Pradhan Mantri Fasal Bima Yojana (PMFBY) was launched, it was made mandatory for all farmers with crop loans to enrol for insurance cover under the scheme.

Another significant change that has been made is that the Centre has almost halved its contribution to the schemes, slashing its share of the premium subsidy from the current 50% to just 25% in irrigated area and 30% for unirrigated areas.

In such a scenario, will the farmers’ share in the premium go up? Or will the states start separating themselves from this scheme as the burden would be on them to pay the premium?

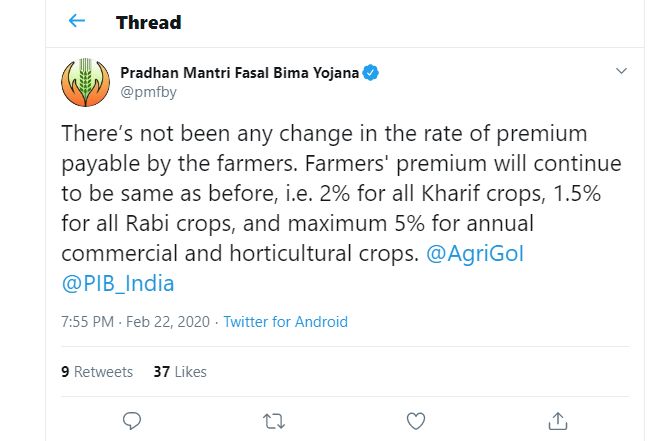

On February 22, Ashish Bhutani, the CEO of PMFBY and the joint secretary in the agricultural ministry had clarified saying: “The changes made to the Pradhan Mantri Fasal Bima Yojana will not have any impact on the farmers and the premium rate will not go up.” On the same day, the official twitter handle of PMFBY mentioned in a tweet: “There’s not been any change in the rate of premium payable by the farmers. Farmers’ premium will continue to be same as before, i.e. 2% for all Kharif crops, 1.5% for all Rabi crops, and maximum 5% for annual commercial and horticultural crops.”

After the Cabinet meeting on February 19, Union Agriculture and Farmers’ Welfare Minister, Narendra Singh Tomar, had said: “Some changes have been made to make the crop insurance schemes more effective. In the past three years, among the insured, the percentage of the farmers who took loans has gone up to 58 and that of non-indebted farmers 42. Before 2015, the percentage of non-loan farmers was only 5. But there was a demand from the state governments and farmer unions to make the schemes voluntary, so we have done that.”

He added that the Centre’s share for North-Eastern states has been increased from 50 per cent to 90 per cent, the remaining 10 per cent will have to be paid by the states. However, then, the Union minister did not mention the reduction in Centre’s share in the premium payable for the rest of the country.

The day after the Narendra Modi Cabinet took the decision, Randeep Singh Surjewala, the Congress spokesperson, accused the government of secretively cutting the premium amount of the insurance scheme.

“So far, the farmers were paying 2 per cent premium under the Pradhan Mantri Fasal Bima Yojana and the remaining 98 per cent was given by the Centre and the states governments on a 50-50 per cent basis. But the Narendra Modi Cabinet has reduced the Centre’s share to 25 per cent from 50 per cent. It means that the farmer will now have to pay 27 per cent (25 per cent plus 2 per cent). In short, the farmer will not be able to pay the premium and get the insurance.”

However, countering this claim, agriculture expert, Ramandeep Singh Mann wrote on social media: “I don’t think the central government has cut its share of premium by 25 per cent, but, if the crop insurance premium is more than 25 per cent in irrigated districts, the central government will not give its subsidy in insurance. Either the amount that is more than 25 per cent is paid by the state government, or there will be no crop insurance in that district.”

In a press conference that was organized after the decision was taken by the Cabinet, a question was asked to the agriculture minister if the premium amount will go up with the number of participating farmers going down in numbers, he responded that although the number is expected to fall in the first year, it is generally not expected for the premium to increase and that they will also run an awareness drive.

When the Pradhan Mantri Fasal Bima Yojana was launched in 2016, the farmer had a premium share of 1.5 per cent for rabi crop and 2 per cent for Kharif whereas, 5 per cent premium for cash crops was payable by the farmer. In the very next year 2017-18, the number of farmers registering for Pradhan Mantri Fasal Bima Yojana had fallen from the previous insurance scheme of the year 2015.

Former finance minister P Chidambaram hailed reducing the Centre’s contribution in the crop insurance scheme as an anti-farmer decision. The Congress has also raised a number of questions while accusing the government of ignoring farmers over changes in the crop insurance scheme. Congress spokesperson Randeep Singh Surjewala questioned the government while releasing the data for the last three years. He remarked that previously, the 12 per cent premium was considered unfair by the present prime minister, but what would he say on charging 27 per cent?

He questioned the government and asked why should the state governments bear their 50 per cent share if the central government does not pay its premium amount. If the state governments also cut their share of premium by 25 per cent on the lines of the Centre, the farmer’s share in the premium will spike up from 27 to 52, which would be impossible for the farmer to bear. This means, the scheme is ready for a lockout.

Surjewala alleged that the scheme benefited insurance companies. In a press conference, he mentioned that in the past three years, the insurance companies have raised Rs 77,801 crore as premium from PMFBY and made profits worth Rs 19,202 crore.

“Insurance companies to float tenders in the state for three years”

The central government, after the February 2019 Cabinet meeting, also informed that a decision has been taken which will call for insurance companies to float tenders in the states for three years. Also, the state governments would also have to pay premiums within the stipulated time.

The Union Agriculture Minister informed reporters that looking at the past three years, it was observed that the state governments, who had floated the annual tenders with the insurance company, faced a lot of difficulties. So, now, when the state governments seek tender from the companies, it would be for a period of three years. Also, many a times, the state governments did not give their share of the premium to the company, which affected the farmers adversely, so it has been decided for the states to pay their share for Kharif by March 31, and rabi by September 30. The defaulting states will be excluded from the benefits of the scheme.

The Congress has also questioned this decision. The Congress spokesperson said that if the premium is delayed, the Pradhan Mantri Fasal Bima Yojana and weather-based crop insurance scheme will be discontinued in these states, which will harm only the farmers.

After the cabinet meeting, Tomar had said that 30% of the total sowing area in the country has been insured. In the past three years, the farmers’ premium of about Rs 13,000 crores was deposited and their claims of about Rs 60,000 crore (45 times) were paid. The scheme has proved helpful during hour of need.

Earlier, the premium used to be deducted from the bank accounts of farmers who had taken loan through the Kisan Credit Card (KCC). These farmers were not sent any intimation before the deductions were made.

“Earlier, the bank deducted the premium without asking and gave it to the insurance companies. The farmer did not know what the premium deposited for his crop amounted to,” said Abhimandu Kohar, who is associated with the Indian National Kisan Mazdoor Mahasangh.”

He added: “Say, a farmer had planted wheat in his field, but the insurance company insured sugarcane instead and deducted the premium. Now, even if the farmer wants to stake a claim, he can’t because the insurance was of sugarcane, and the farmer had sown wheat.”

Gaon Connection spoke to farmers in several states regarding the cabinet decision. “Voluntary insurance is the right decision because the premium got deducted whenever the farmer used to transact in the bank’s loan account. Now, we will be able to do it at our own discretion,” said Amarendra Singh, a progressive farmer from Uttar Pradesh.

In a separate move, the Centre has come out with customized crop insurance for states by factoring in one specific natural disaster. Such insurance will be made available to farmers in Punjab, parts of Haryana and western Uttar Pradesh where farmers are not generally hit by droughts or floods but have to suffer due to hailstorms.

The major changes made by the central government

1. Pradhan Mantri Fasal Bima Yojana and weather-based crop insurance scheme will now be voluntary, money will not be deducted from Kisan Credit Card.

2. Farmers can seek insurance as per their choice and requirement whether for drought or floods together or separately.

3. The Central subsidy in irrigated areas under PMBFY and RWBCIS will be limited to 25% for irrigated and 30% for non-irrigated sector.

4. States which do not pay their share within the stipulated time will be excluded from the scheme.

5. Insurance companies in states will fill the tender for at least three years instead of one year.

4. For the 151 calamities stricken (flood and water logging etc.) districts of the country, a special insurance scheme shall be floated

6. Technology like weather satellite will be brought into use for damage assessment and claim settlement.

7. The administrative expenditure, not include at first in the crop insurance scheme, would now be 3 per cent.